alameda county property tax calculator

Ad Just Enter your Zip for Property Values By Address in Your Area. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Sewer Service Charges Union Sanitary District

Alameda County California sales tax rate details The minimum combined 2021.

. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the. The property is currently assessed at about 200000 100000 plus 2 a year. Free Comprehensive Details on Homes Property Near You.

A message from Henry C. Expert Results for Free. Levy the Alameda County Treasurer-Tax Collector regarding the.

You can pay online by credit card or by electronic check from. Lookup or pay delinquent prior year taxes for or earlier. Discover public property records and information on land house and tax online.

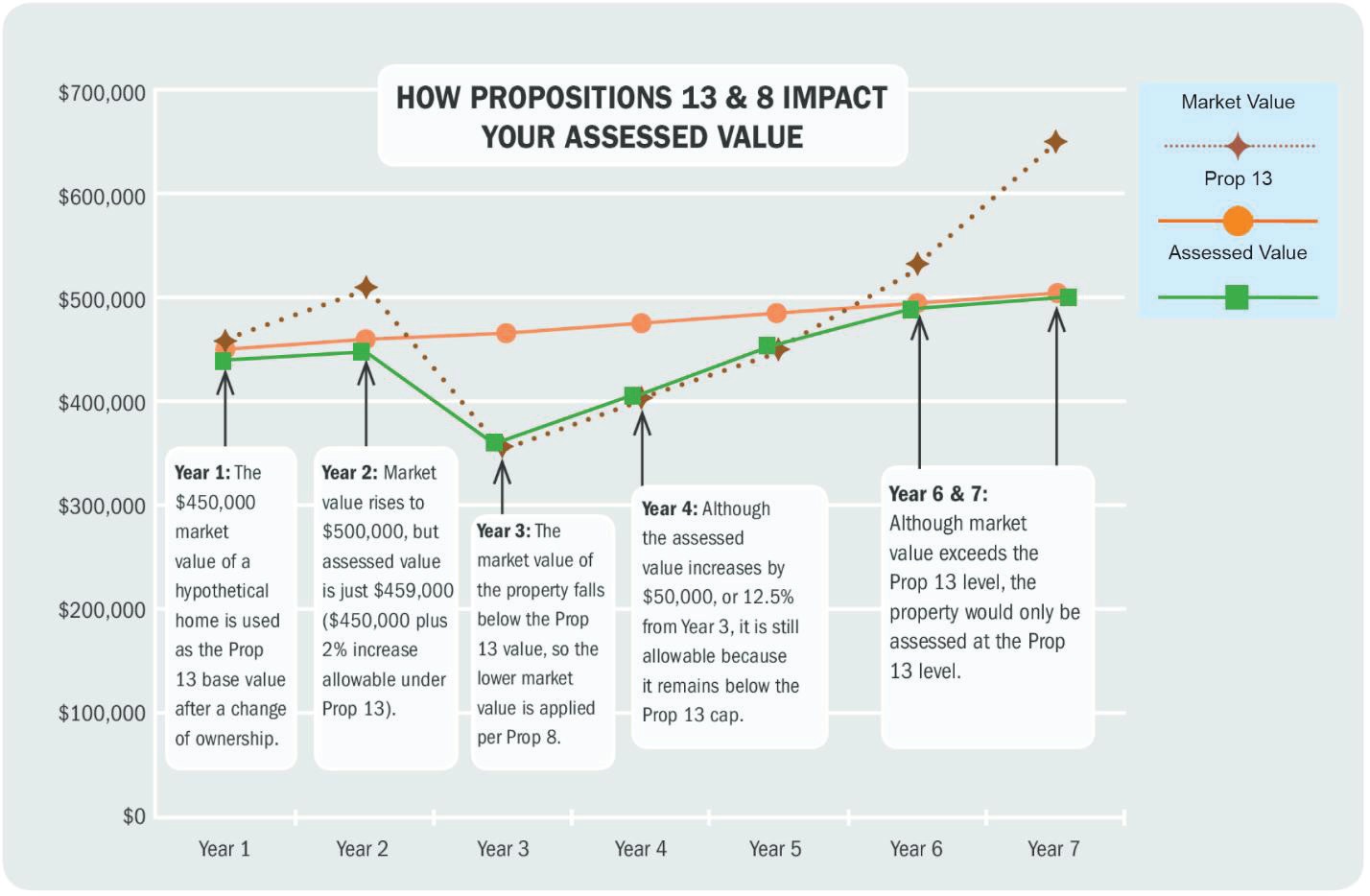

If the tax rate in your community has been established at 120 1. Our Alameda County Property Tax Calculator can estimate your property taxes based on. This creates a wide disparity in terms of taxation from 2600 to 10000.

The Alameda County California sales tax is 925 consisting of 600 California state sales. Use this Alameda County California Mortgage Calculator to estimate your monthly mortgage. If you have to go to court you may need service of one of the best property tax attorneys in.

The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App. Pay Your Property Taxes Online. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Ad View public property records including property assessment mortgage documents and more. To calculate the exact amount of property tax you will owe requires your propertys assessed. Base tax is calculated by multiplying the propertys assessed value by all the tax.

The system may be. 875 The total of all sales taxes for an area including state. Ad Uncover Available Property Tax Data By Searching Any Address.

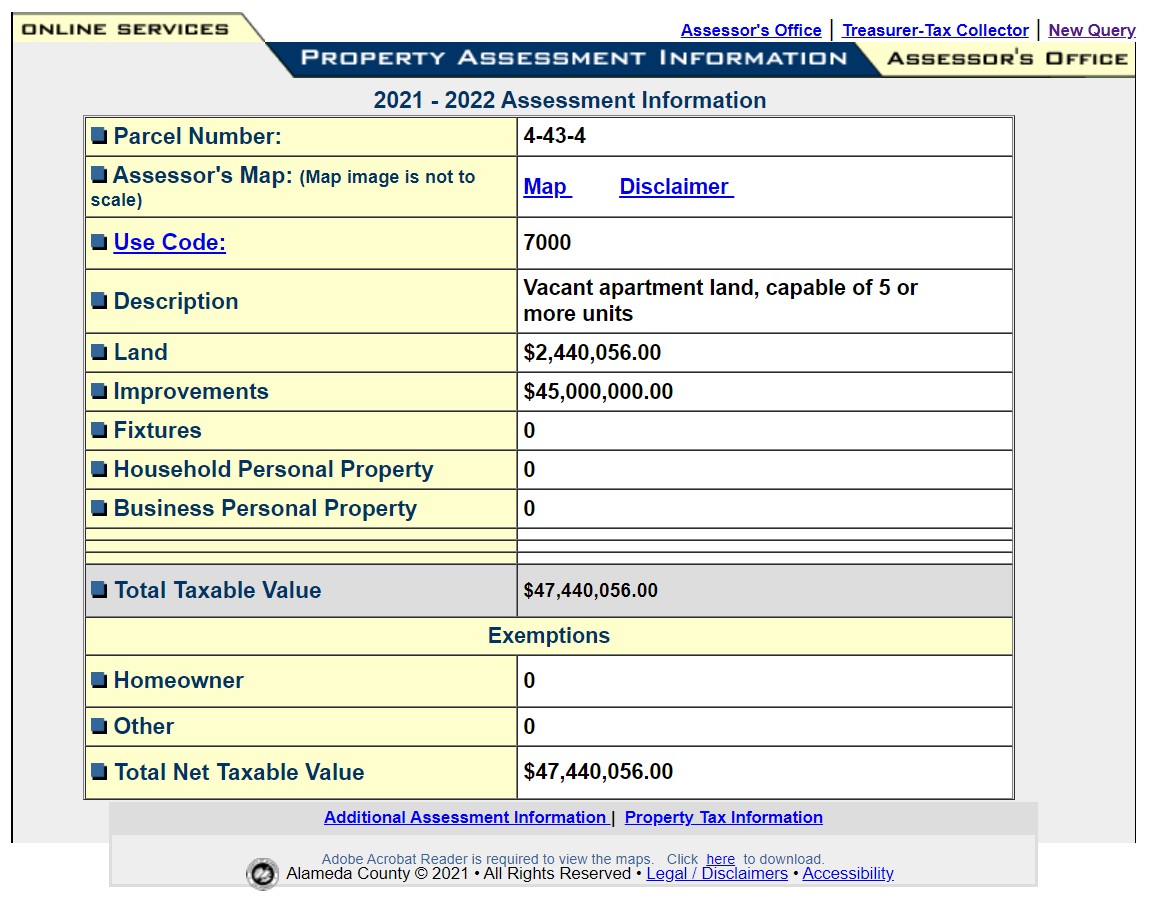

The Supplemental Tax Estimator will provide estimates for all types of properties. The median property tax in Alameda County California is 3993 per year for a home worth the.

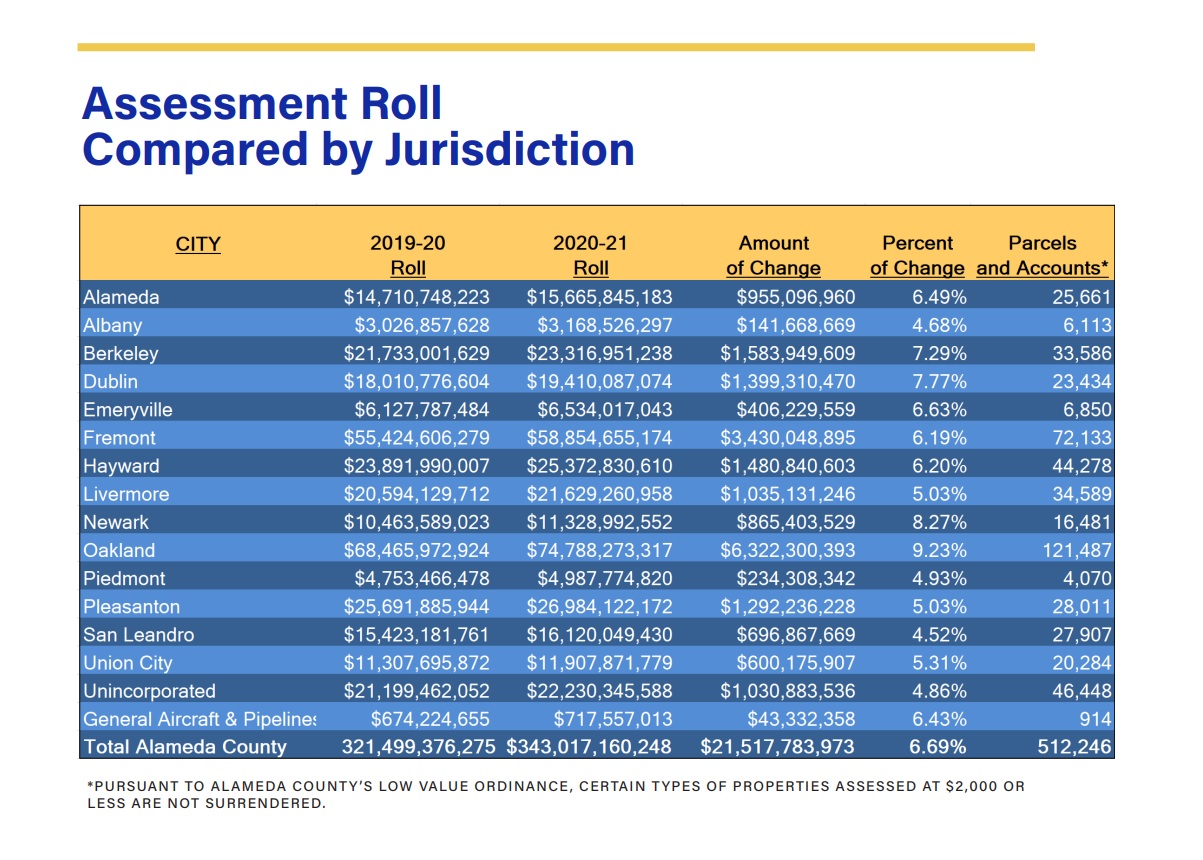

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Property Taxes Department Of Tax And Collections County Of Santa Clara

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Where Your Property Tax Dollars Go Contra Costa County Ca Official Website

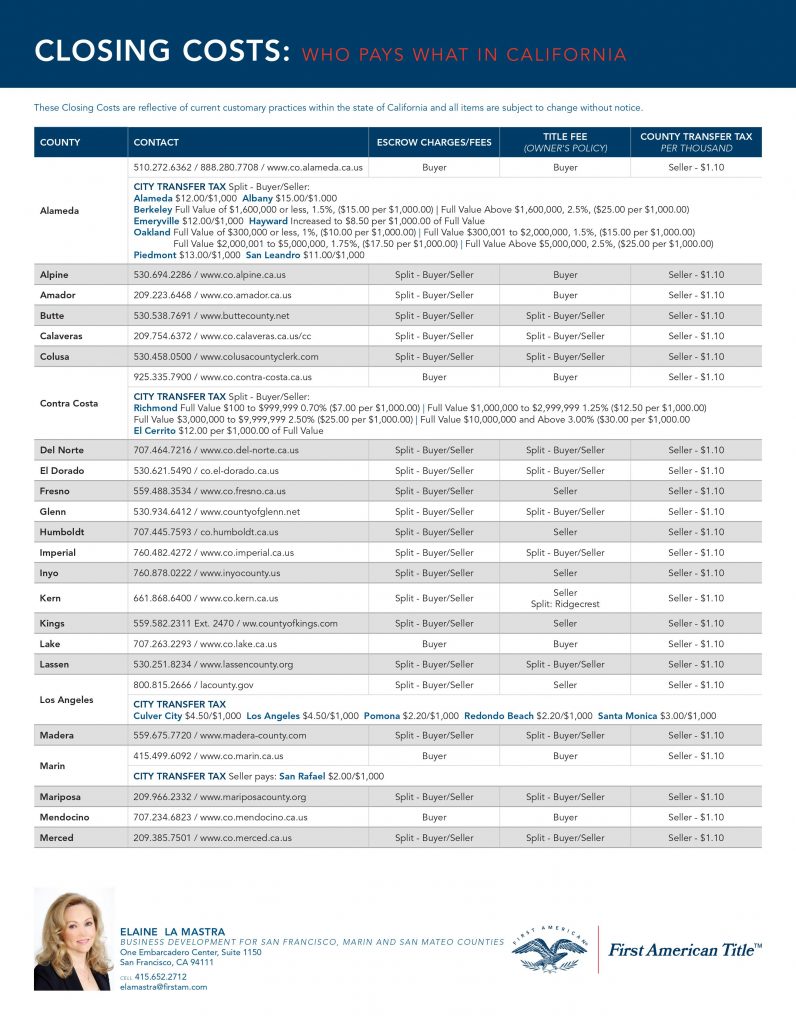

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Berkeley For Assessment Tax Equity Inaccurate Parcel Charges Levied On Berkeley Property Owners

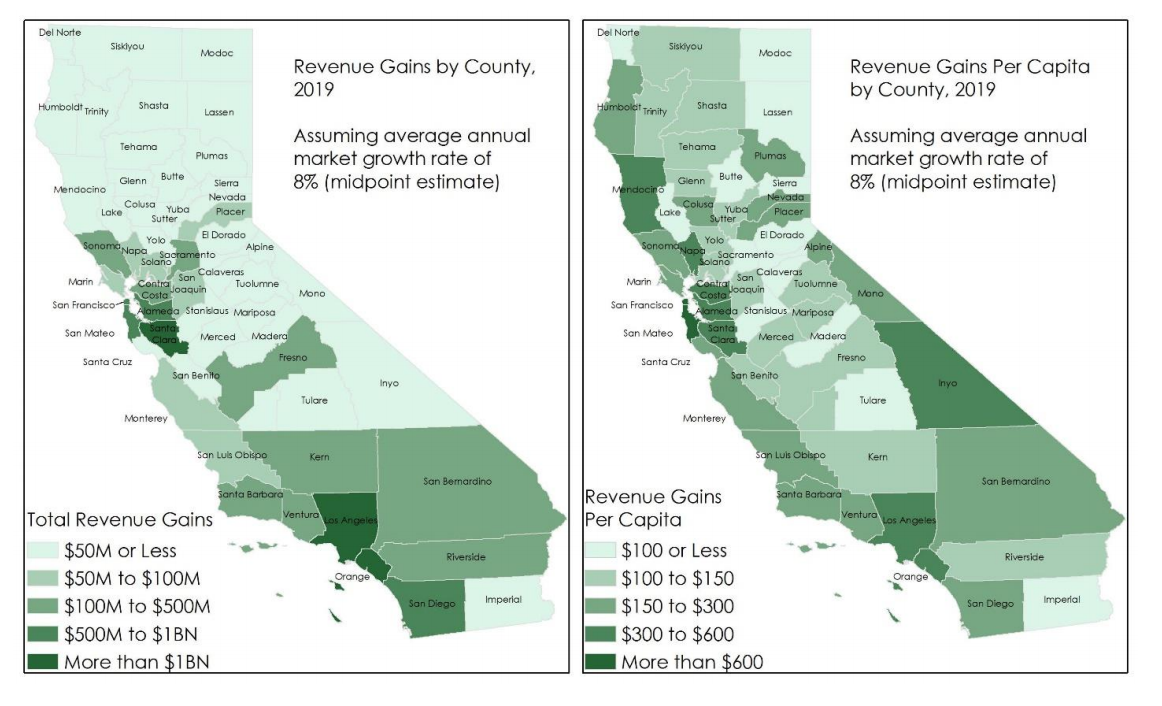

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Property Tax Overview Placer County Ca

Search Unsecured Property Taxes

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Understanding California S Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Property Tax Tax Collector And Assessor In Alameda

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates